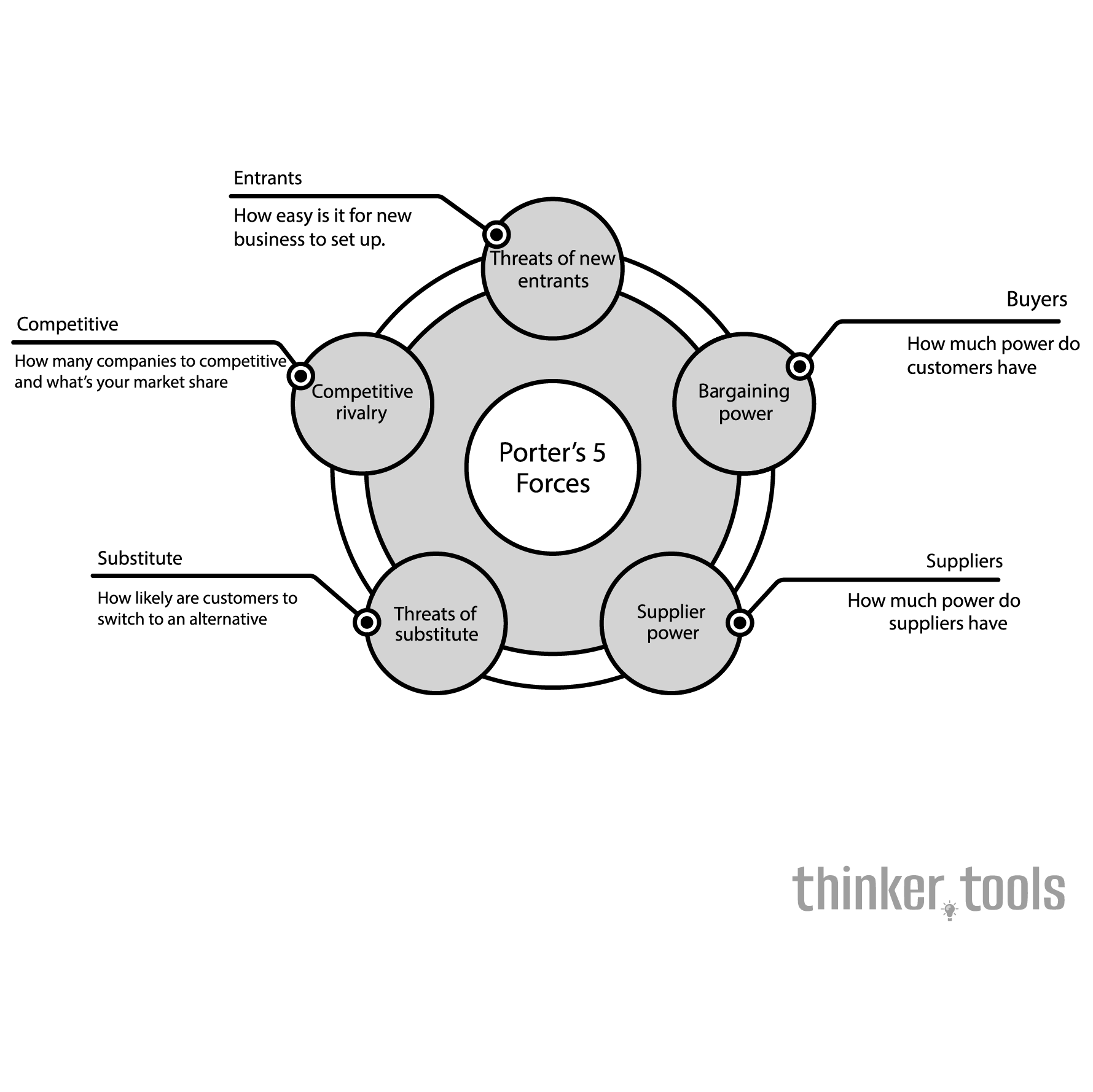

What is Porter's Five Forces?

Porter's Five Forces is a framework that identifies and analyzes five competitive forces that shape every industry and helps determine an industry's weaknesses and strengths. The five forces are: Competition in the Industry, Potential of New Entrants, Power of Suppliers, Power of Customers, and Threat of Substitute Products. By understanding these forces, businesses can adjust their strategy to improve their competitive position and profitability.

History and Origin

Developed by Michael E. Porter of Harvard Business School in 1979, this framework was first introduced in his article "How Competitive Forces Shape Strategy" in the Harvard Business Review. Porter, now recognized as the father of modern competitive strategy, created this model as part of his broader work on competitive advantage. The framework revolutionized how businesses think about competition, moving beyond simple competitor analysis to a more holistic view of the competitive environment. It remains one of the most widely used strategic planning tools more than four decades after its introduction.

How to Use Porter's Five Forces: Step by Step

Step 1: Analyze Competitive Rivalry

Examine the intensity of competition among existing firms in your industry:

- How many competitors exist?

- What is their relative size and strength?

- Is the industry growing or declining?

- How differentiated are products/services?

- What are the exit barriers?

High rivalry typically leads to price wars, advertising battles, and constant innovation, all of which can erode profitability.

Step 2: Assess Threat of New Entrants

Evaluate how easy it is for new competitors to enter your market:

- What are the capital requirements?

- Are there economies of scale advantages?

- How strong is brand loyalty?

- What regulatory barriers exist?

- Do incumbents control key distribution channels?

Low barriers to entry mean new competitors can quickly emerge and capture market share.

Step 3: Evaluate Bargaining Power of Suppliers

Determine how much power your suppliers have:

- How many suppliers are available?

- How unique is their product/service?

- What would switching suppliers cost?

- Can suppliers forward integrate into your business?

- How critical is their input to your product?

Powerful suppliers can squeeze profitability by charging higher prices or reducing quality.

Step 4: Analyze Bargaining Power of Buyers

Assess how much power your customers have:

- How concentrated are your buyers?

- What portion of their costs does your product represent?

- How standardized is your product?

- What are their switching costs?

- Can they backward integrate?

Powerful buyers can force prices down, demand better quality, and play competitors against each other.

Step 5: Consider Threat of Substitutes

Identify products or services that could replace yours:

- What alternatives can perform the same function?

- How do their price-performance ratios compare?

- What is the cost of switching to substitutes?

- What trends might make substitutes more attractive?

The threat of substitutes places a ceiling on prices and limits industry profitability.

Step 6: Synthesize and Strategize

Combine your analysis of all five forces to understand overall industry attractiveness and identify strategic options:

- Which forces are strongest/weakest?

- Where can you influence the forces in your favor?

- Should you compete in this industry?

- How can you position yourself optimally?

Practical Examples

Streaming Services Industry Example:

- Competitive Rivalry: High (Netflix, Disney+, HBO Max, etc.)

- New Entrants: Moderate (high content costs but low technical barriers)

- Supplier Power: High (content creators and studios have significant leverage)

- Buyer Power: Moderate to High (low switching costs for consumers)

- Substitutes: High (traditional TV, YouTube, gaming, social media)

Strategic Response: Focus on exclusive content, bundle services, and improve user experience.

Local Coffee Shop Example:

- Competitive Rivalry: High (many cafes, plus chains like Starbucks)

- New Entrants: Low barriers (relatively small capital requirements)

- Supplier Power: Low (many coffee suppliers available)

- Buyer Power: Moderate (customers can easily switch but may value convenience)

- Substitutes: High (home brewing, energy drinks, tea)

Strategic Response: Differentiate through atmosphere, community connection, and unique offerings.

Enterprise Software Example:

- Competitive Rivalry: Moderate (fewer players, high switching costs)

- New Entrants: High barriers (technical expertise, capital, reputation needed)

- Supplier Power: Low (many developers and cloud providers)

- Buyer Power: Moderate (large contracts but high switching costs)

- Substitutes: Low (specialized solutions hard to replace)

Strategic Response: Focus on customer lock-in, continuous innovation, and expansion of features.

Benefits and Life Improvements

Porter's Five Forces framework delivers significant benefits for strategic decision-making:

Comprehensive Industry Understanding: The framework provides a complete picture of your competitive environment, revealing threats and opportunities you might otherwise miss.

Better Strategic Decisions: By understanding the forces at play, you can make informed decisions about where to compete, how to position yourself, and where to invest resources.

Anticipate Industry Changes: Regular analysis helps you spot shifts in competitive dynamics before they fully materialize, allowing proactive rather than reactive strategies.

Investment Decisions: Investors use Five Forces analysis to evaluate industry attractiveness and make better capital allocation decisions.

Negotiation Leverage: Understanding supplier and buyer power dynamics improves your negotiation position and helps structure better deals.

Innovation Direction: The framework highlights where innovation can create the most value by weakening competitive forces or creating barriers to entry.

Personal Career Applications: Individuals can use Five Forces to analyze their job market, understanding competitive dynamics in their profession and making better career decisions.

Porter's Five Forces remains relevant because it addresses fundamental economic forces that exist in every industry. While digital transformation and globalization have changed how these forces manifest, the underlying framework continues to provide valuable insights. By systematically analyzing each force, businesses can develop strategies that exploit industry structure rather than being victimized by it. Whether you're a startup founder, corporate strategist, or individual planning your career, mastering Porter's Five Forces equips you with a powerful lens for understanding and shaping your competitive environment.