What is Risk Management?

Risk Management is the coordinated activities to direct and control an organization or individual with regard to risk. It involves identifying potential events that may affect objectives, assessing their likelihood and impact, and developing strategies to manage them. Rather than avoiding all risks, effective risk management helps determine which risks are worth taking and how to minimize negative impacts while maximizing positive opportunities.

History and Origin

While humans have always managed risks informally, modern risk management emerged in the 1950s and 1960s from the insurance industry. The discipline gained prominence after major disasters like the Bhopal gas leak (1984) and Chernobyl (1986) highlighted the need for systematic risk assessment. The field evolved from focusing purely on insurable risks to encompassing strategic, operational, financial, and reputational risks. Today's risk management frameworks draw from diverse fields including finance, engineering, psychology, and systems theory, reflecting our understanding that risks are interconnected and multifaceted.

How to Use Risk Management: Step by Step

Step 1: Establish Context

Define the scope and objectives of your risk management effort:

- What are you trying to achieve?

- What are your risk criteria and tolerance levels?

- Who are the stakeholders?

- What is the internal and external environment?

Step 2: Risk Identification

Systematically identify what could go wrong (or right):

- Brainstorm with diverse perspectives

- Review historical data and lessons learned

- Use checklists and risk categories (strategic, operational, financial, compliance)

- Consider both negative risks (threats) and positive risks (opportunities)

- Document risks in a risk register

Step 3: Risk Analysis

Analyze identified risks to understand their nature:

- Qualitative Analysis: Assess probability (likelihood) and impact (consequence) using scales like High/Medium/Low

- Quantitative Analysis: Use numerical techniques like Monte Carlo simulation for critical risks

- Consider risk velocity (how quickly a risk could impact)

- Evaluate risk interconnections and correlations

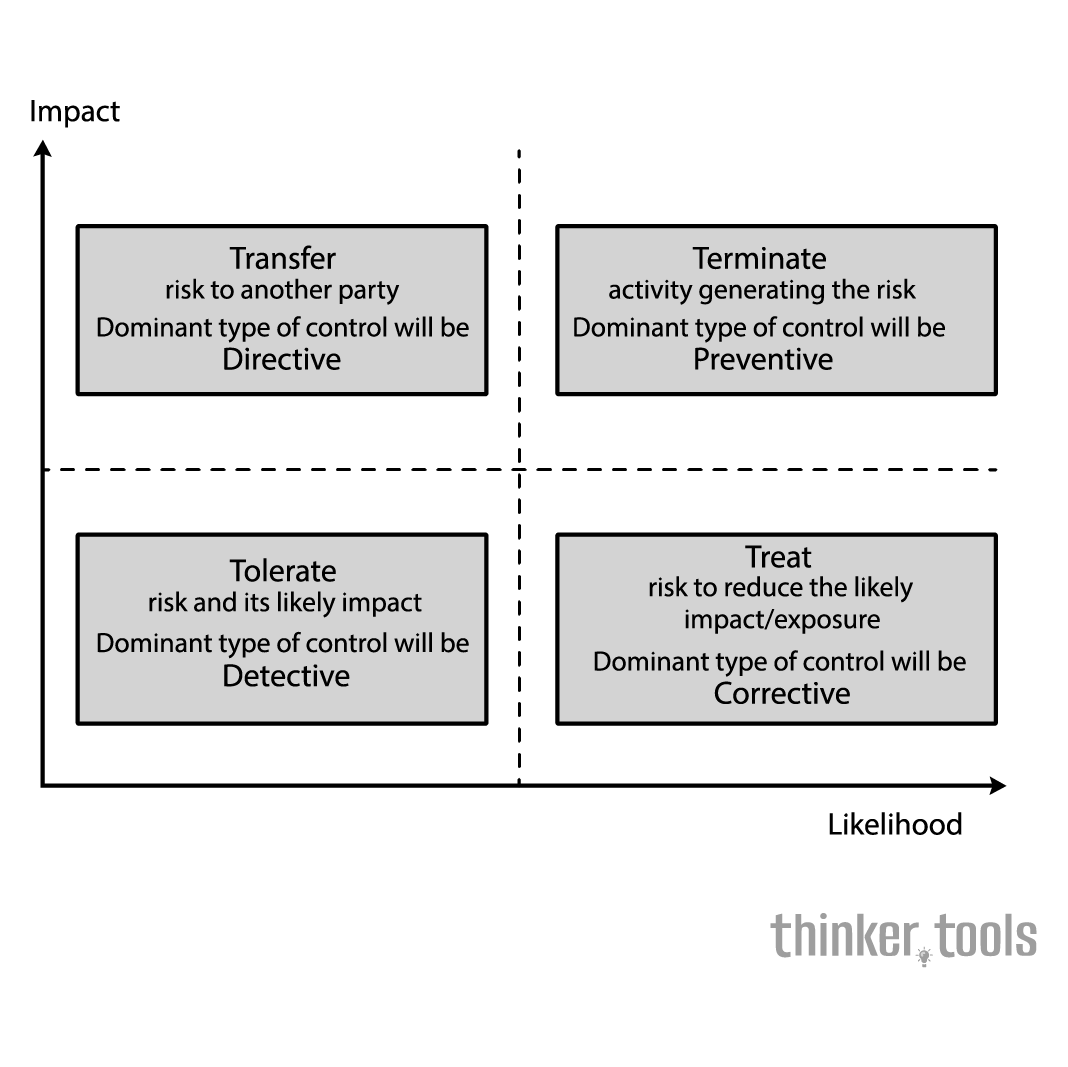

Step 4: Risk Evaluation

Prioritize risks for treatment:

- Plot risks on a probability-impact matrix

- Compare risk levels against risk criteria

- Identify which risks require immediate attention

- Consider cost-benefit of different response options

Step 5: Risk Treatment

Develop and implement strategies for priority risks:

- Avoid: Eliminate the risk by not engaging in the activity

- Reduce/Mitigate: Implement controls to lower probability or impact

- Transfer/Share: Shift risk to another party (insurance, contracts)

- Accept: Acknowledge and monitor the risk without active treatment

- Exploit (for opportunities): Increase probability or impact of positive risks

Step 6: Implementation

Put risk responses into action:

- Assign risk owners with clear responsibilities

- Develop detailed action plans with timelines

- Allocate necessary resources

- Integrate risk responses into regular operations

Step 7: Communication and Consultation

Ensure effective information flow:

- Regular risk reporting to stakeholders

- Clear escalation procedures

- Two-way communication to gather insights

- Transparent documentation of decisions

Step 8: Monitoring and Review

Continuously improve the risk management process:

- Track risk indicators and triggers

- Monitor effectiveness of controls

- Identify new and emerging risks

- Update risk assessments regularly

- Learn from risk events that occur

Practical Examples

Technology Startup Example:

- Risk: Key developer leaves the company

- Analysis: High probability, High impact

- Treatment: Reduce through knowledge documentation, cross-training, and retention bonuses

- Monitoring: Track employee satisfaction scores and market salary benchmarks

Event Planning Example:

- Risk: Outdoor wedding threatened by rain

- Analysis: Medium probability (based on historical weather), High impact

- Treatment: Transfer (event insurance) + Reduce (rent tents as backup)

- Monitoring: Track weather forecasts starting two weeks before

Personal Finance Example:

- Risk: Job loss affecting mortgage payments

- Analysis: Low probability, Severe impact

- Treatment: Reduce through emergency fund (6 months expenses) + Transfer (income protection insurance)

- Monitoring: Regular review of job market and skill relevance

Supply Chain Example:

- Risk: Single supplier dependency for critical component

- Analysis: Medium probability of disruption, Severe impact on production

- Treatment: Reduce by qualifying alternative suppliers + Accept residual risk

- Monitoring: Supplier financial health checks and performance metrics

Benefits and Life Improvements

Implementing systematic risk management delivers profound benefits:

Improved Decision Making: Understanding risks enables better-informed choices, balancing potential rewards against possible downsides.

Reduced Surprises: While you can't eliminate uncertainty, risk management reduces the frequency and severity of negative surprises.

Resource Optimization: By focusing on high-priority risks, you allocate resources where they provide the most protection and value.

Enhanced Reputation: Organizations known for effective risk management enjoy greater stakeholder trust and confidence.

Competitive Advantage: Better risk management allows organizations to take calculated risks that competitors might avoid, creating opportunities.

Stress Reduction: Personally, having plans for potential problems reduces anxiety and improves mental well-being.

Goal Achievement: By anticipating and managing obstacles, you're more likely to achieve objectives on time and within budget.

Learning and Adaptation: The process creates a culture of continuous improvement and organizational learning.

Regulatory Compliance: Many industries require formal risk management, making this framework essential for operations.

Risk Management transforms uncertainty from a source of fear into a manageable aspect of pursuing any worthwhile objective. By providing a structured approach to thinking about what could go wrong (or right), it empowers both organizations and individuals to move forward with confidence. Whether you're launching a business, planning a major purchase, or navigating career changes, risk management tools help you prepare for multiple futures while focusing energy on what matters most. The framework reminds us that the goal isn't to eliminate all risk—which would eliminate all opportunity—but to take the right risks in the right way.